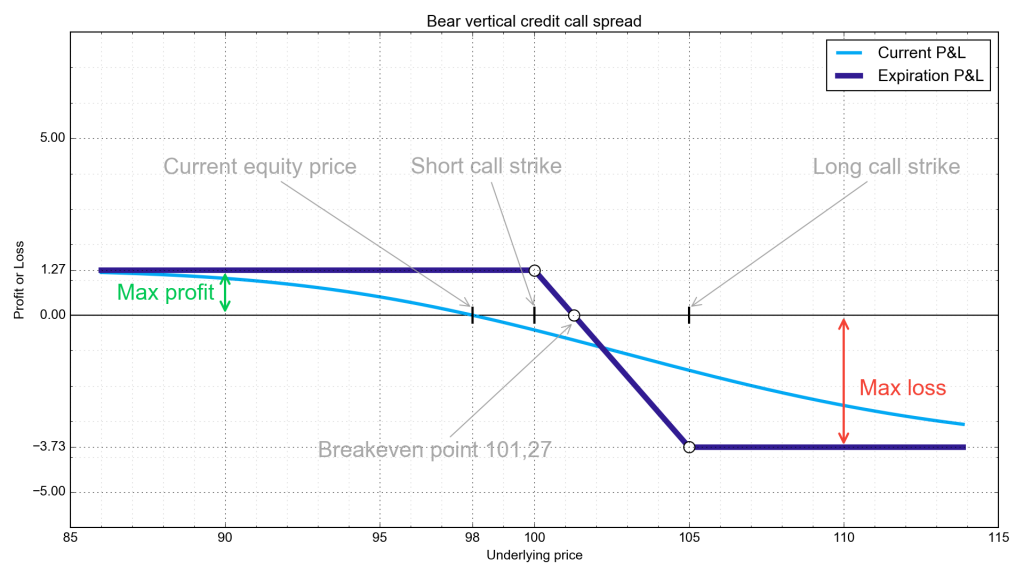

Bear Call Spread

Bear Call Spread. An alternative name is Credit Call Spread. Bearish position. It is a vertical spread involving an equal number of long and short calls on the same underlying asset and with the same expiration date. It is a credit spread, which means you receive money to put on the position. The strategy profits as long as the price of the underlying security remains below the breakeven point.