Strategy templates

With this post we are going to open a category of publications, where we write about our plans to implement new features into Option Workshop. We hope these posts will turn into a dialog with users, so everyone is welcome to comment about these post here at our blog, in our google plus pages or at the support portal/forum.

The need

There are different approaches to options trading. One of them is trading standard options combinations, like butterflies, vertical spreads and so on. Beginners can simply buy/sell one of these combinations with the hope that the price of the underlying will be within a profitable range. Advanced traders will manage the position over its lifetime. But both beginners and advanced traders need to find a convenient way to observe and discover the best opportunities to open any position.

Traders need a fast way to understand all of the following factors: the price, the greeks, the maximum profit and the maximum risk if they opens a spread at a particular strike.

Another need is the ability to create custom templates, for spread trades that are regularly put on. For example, some traders like to trade ‘standard’ butterflies that only have a one strike distance or ‘step’ between the leg and the center. Others trade a ‘wider’ butterfly with a 2 or 3 strike step between the wing and the core. With a custom template, it will be possible to specify the difference between the step, be it a 1, 2 or 5+ strike distance. Additionally, because of it’s flexibility, you could build the butterfly out of calls or puts, or any combination of both.

Syntax

We plan to create a simple syntax for describing combinations in relative form, i.e. without binding it to a concrete underlying, series or strike.

Let’s start with an example of a combination description in a format which we’ll consider now:

1c-1,-2c,1c+1This is a description of a simple long butterfly made up of call options. Let’s see in detail how this syntax works:

- The template description row consists of several parts split up by a comma.

- The first part is

1c-1. It by-turn consists of1cand-1.1cmeans "one bought call option",-1means "at strike which lies one step down to the central strike". - The second part is

-2c. It doesn’t have a second fraction like-1in first part. It means that it describes the central strike. So-2cmeans "two sold call options at the central strike". - The third part is

1c+1, meaning "one long call option at a strike one step higher than the central strike".

Central strike is a term in the description above. It is the strike that the spread is built up around. If we build the spread above at a central strike of 100 (with the step distance between the strikes being 5), then:

-2c– is two short calls at a strike of 100;1c-1is one long call at a strike of 95;1c+2is one long call at a strike of 105.

If we build it at strike 110, then all strike in the list above must be increased by 10.

Here are a few more examples:

1c, 1p– a straddle;1c+1, 1p-1– a strangle with a two strike width;1c, -1c+1– a vertical bull spread.

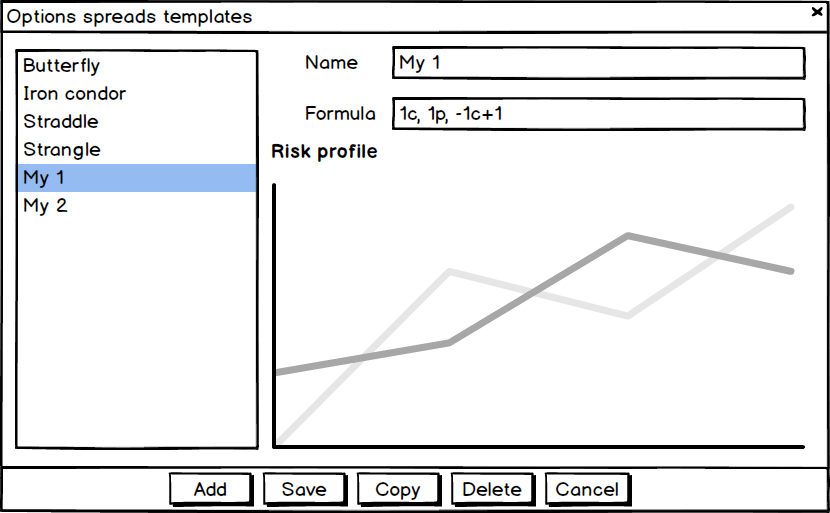

Templates editor interface prototype

The layout for a template editor seems to be very simple. See the image above. It will have the list of default and user defined templates and two interface elements for editing:

- A text field for the template name;

- A text field for the template formula.

For clarity it will be useful to add a small chart, that will show a qualitative risk profile at expiration (payoff function).

Use of templates

Quotes and other parameters

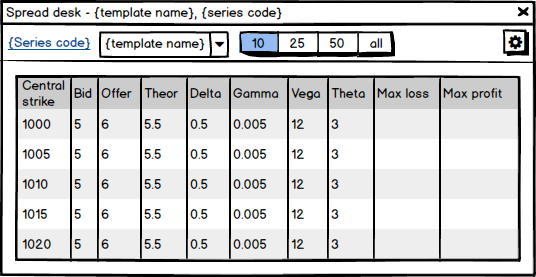

There is a class of traders who think in terms of prices of option spreads. For example, if someone trades butterflies regularly, then it’s natural for him to think of the butterflies price. IE: “how much is the bid and the offer for a butterfly trading at the 100 strike?”. Or, what is the current delta/gamma/vega value for this spread and so on.

For these traders it’ll be convenient to have a table, which will show all the parameters of a particular option spread with all the different strikes (all possible combinations within an options series). The image above illustrates a prototype of this.

Quick strategy creation from template

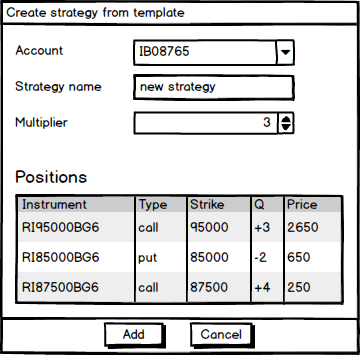

Simple and obvious functionality. If a trader wants to model a position in an options spread, at the moment they need to manually add a position in each leg. It is very flexible and gives the ability to model absolutely any options spread, but it’s time consuming in a situation, where the user needs to model something standard.

What we want to do is to give users the ability to add their butterflies/condors/strangles into a modelling account or strategy in a single click. In the context menu of a row in the options desk the software will show the item Templates with subitems titled by existed templates names. After the user clicks on an item, the following form will appear:

The form will require a user to choose an account, where he wants to add a modelling position, a strategy name (new or existing) and a multiplier – a value at which a number of legs in each leg of the template must be scaled.

What do you think? Tell us here in the comments or anywhere on our social networks pages.

Permalink