Vertical Bull Debit Call Spread

Strategy name and alternative names

Vertical bull debit call spread. An alternative shorter name is bull call spread.

Main characteristics

Moderately bullish. It is a vertical spread, which means it involves two or more options at different strike prices with the same expiration date. It is a debit spread, which means you must pay to put on the position. The strategy profits when the underlying security rises moderately.

Options used in the spread

Buy to open one at-the-money (ATM) call and simultaneously sell to open one out-of-the money (OTM) call. Both calls derive from the same underlying stock. The advantage of this spread is that the credit from the sale of the OTM call partially offsets the debit paid for the ATM call. Basically, the spread allows you to buy the ATM call at a discount in exchange for a cap on the maximum profit you can extract from the spread.

Risk profile

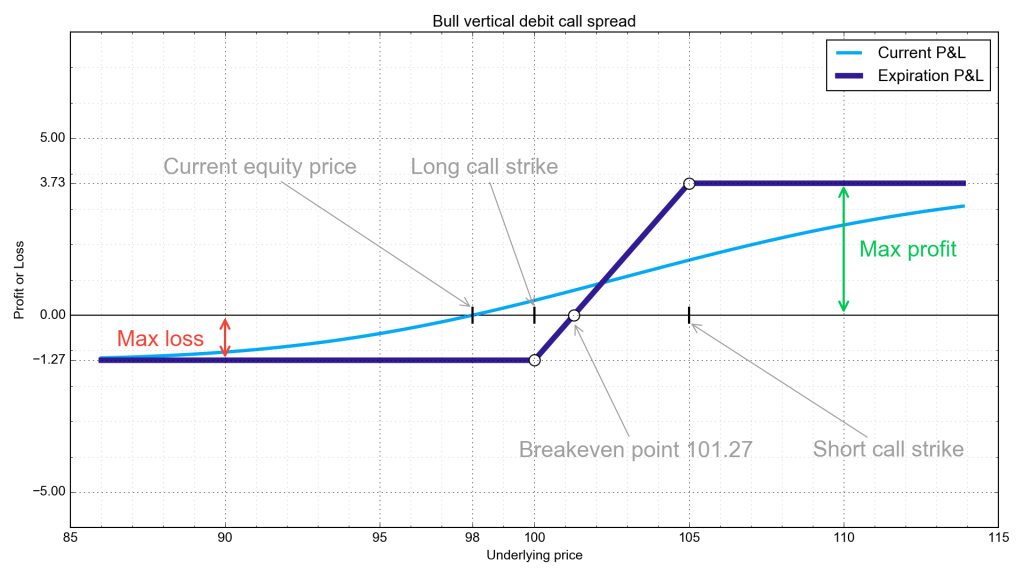

Maximum profit : Equals the strike price of the OTM call minus the strike price of the ATM call minus the net premium paid minus commission. Achieved when underlying’s price rises to or above the OTM call’s strike price.

Maximum loss : Net premium paid plus commission. Occurs when underlying’s price is not greater than the ATM call strike price.

Breakeven point : Strike price of ATM call plus net premium.

Key points : On a profit/loss chart (see below) where the X axis is price and the Y axis is profit/loss, the value of the spread from left to right (lower to higher prices) is constant at maximum loss until the underlying’s price exceeds the ATM call’s strike price. The line representing the value of the spread increases diagonally as you move to the right (increasing price). The value is zero at the breakeven point, and reaches its maximum value at the strike price of the OTM call. Further increases in strike prices have no effect on the profit/loss of the spread, which remains constant.

Preconditions to open this spread

You would put on a bull call spread in the hopes that the underlying stock will rise to the strike price of the OTM call by expiration date. You would choose an underlying stock that is relatively volatile, as this increases the chances that the stock price will move toward the OTM call’s strike price (see the vega chart). Since your potential maximum loss is limited, downside volatility has only a limited risk, so you need not fear it as much as you would with a naked short call position (which has an unlimited risk).

You would also choose an expiration date that is not too close, since the time value of the OTM call collapses faster than that of the ATM call as the expiration date approaches, assuming the stock price is still near the ATM call’s strike price. The discount on the spread derives from the decay of an option’s time value as the expiration date approaches (see theta decay chart). If you bought just the ATM call, your debit would equal the intrinsic value (if any) of the call plus its time value (ignoring commissions). By shorting the OTM call, you receive a credit equal to the time value. Therefore, the time values of the two calls partially cancel each other out.

The offset is partial because time value is greatest at the ATM call strike price. The effect is to buy the ATM call option at a discount, which means a higher return on investment when the stock price is above the breakeven point. The breakeven point is lower in the bull call spread as compared to a naked long call, thanks to the credit provided by shorting the OTM call.

Greeks

Delta

An option’s probable price movement in relation to the price movement of the underlying stock.

The value ranges from 0 to 1 for a long call or short put, where 0 means the option price is not affected by the stock price,

and 1 means the option prices moves penny for penny in lockstep with the underlying’s price.

A short call or long put have a delta between 0 and -1, reflecting that these options have values

that move in the opposite direction from those of the underlying stock.

Delta increases for ATM options as the expiration date approaches.

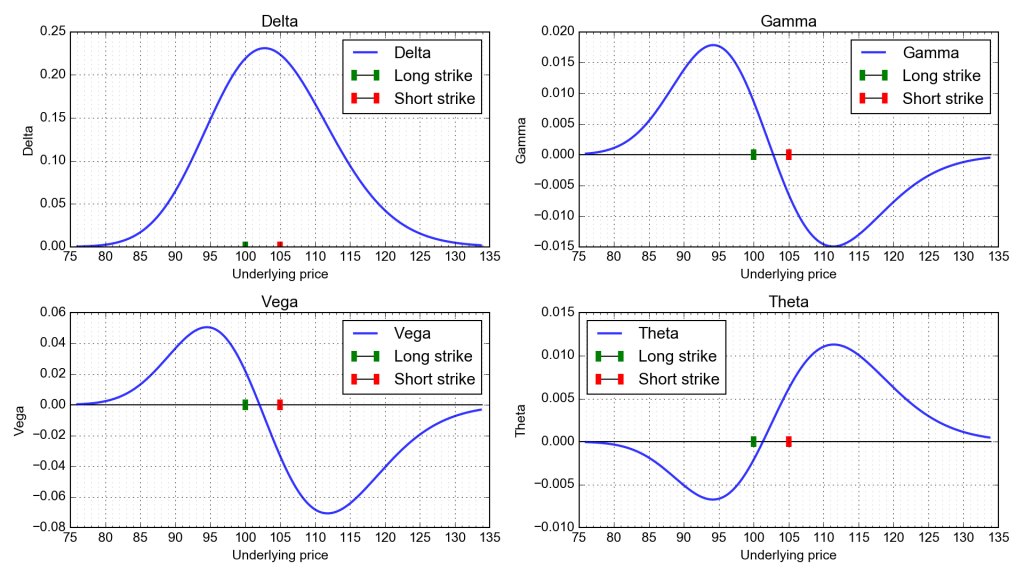

For a bull call spread, delta is initially positive, as the value of the spread increases when the underlying stock price rises.

Vega

The effect of the underlying stock’s volatility on the option’s price.

Higher vega translates into higher option prices, all things being equal.

For example, a vega of 0.3 means that an option’s price will rise by 30 cents for each point increase

in the underlying stock’s implied volatility.

In a bull call spread, vega is positive for options with a short expiration period

but is less positive for options with longer expiration periods.

Theta

The time decay of an option’s price as the expiration date approaches.

At the close of expiration day, the option’s theta is 0.

Theta is lower for long expiration periods, which means the option loses time value more slowly

than it would for short expiration periods.

A longer expiration period increases the chance that the option will expire in the money.

Theta is negative (which means the spread loses value over time) for a bull call spread

if the underlying’s price is below the breakeven point;

Theta becomes positive (i.e., the spread’s price grows with time) when the underlying asset price rises above the breakeven point.

Gamma

This is the rate of change of delta — the responsiveness of the position to the underlying’s price movement. In a bull call spread, gamma is positive below the breakeven point, which leads to delta growth when the underlying price approaches the breakeven point. Above the breakeven point, gamma becomes negative, thereby decreasing delta.

Dynamic illustrations

Position example

Assume Apple (AAPL) is trading at $120.

Buy to open 10 AAPL March 120 calls for $3.20, sell to open 10 AAPL March 125 calls for $1.40.

Neglect commissions.

Net debit: $3.20 – $1.40 = $1.80. You pay $1,800.

If you expect AAPL to go up to near $130 by expiration, you might instead sell to open 10 AAPL March $130 calls.

Maximum profit: 10 x ($500 – $180) = $3,200.

Maximum loss: $1,800.

Breakeven point: $120 + $1.80 = $121.80.

How to manage position

Since this is a debit spread with limited risk and reward, you don’t need much management, but here’s what you can do.

Strong rise in underlying stock price

You could buy to close the OTM call and sell to open an OTM call with the next higher strike price. Alternatively, you could refrain from buying the higher strike call, converting the position into a long call. Lastly, you could simply close out the spread once the stock price hits the OTM call’s strike price, since this represents maximum profit.

Stock price not expected to rise much

You could write extra OTM calls to lower the net cost and the breakeven point. The resulting long call ladder spread has unlimited risk.

Stock price expected to reverse after hitting strike price of OTM call

You can convert to a bear call spread (which see) by selling to close the long call and buying to open a new long call with a strike higher than that of the short call. This position profits from a price decline and has limited profit, limited loss potential.

Variation

You can put on a bull call spread using two OTM calls with different strike prices above the current stock price.

You buy the lower-strike call and sell the higher-strike one.

For example, if the stock price is $120, you buy the $125 call and sell the $130 call.

This can be extremely profitable on a percentage basis if the stock price explodes in your favor.

Of course, the probability of a total loss is much greater,

because the breakeven point lies further away from the current price of the underlying.

Summary

The bull call spread limits your losses if the underlying stock price drops, and limits your profits if the stock price rises. If the stock price rises but never hits the OTM call’s strike price, your ROI will be larger than it would be from a naked long call position. The bull call spread is also an effective way to buy options at a discount. We’ve ignored commissions, but in the real world, you’ll pay more commissions with the spread than you would with a naked long call position.

Permalink