Option Workshop, version 18.2.1657

Polynomial volatility model, notifications through Telegram and Market-maker ergonomic improvements

Polynomial volatility model, notifications through Telegram and Market-maker ergonomic improvements

In this update, we’ve added several improvements: copying a strategy with all fills, a new Mnns (moneyness) column that shows the option status, the ability to bind the Charts form with the active (selected) strategy in the Positions manager, the ability to display the P&L chart taking the commission for the fills into account, etc.

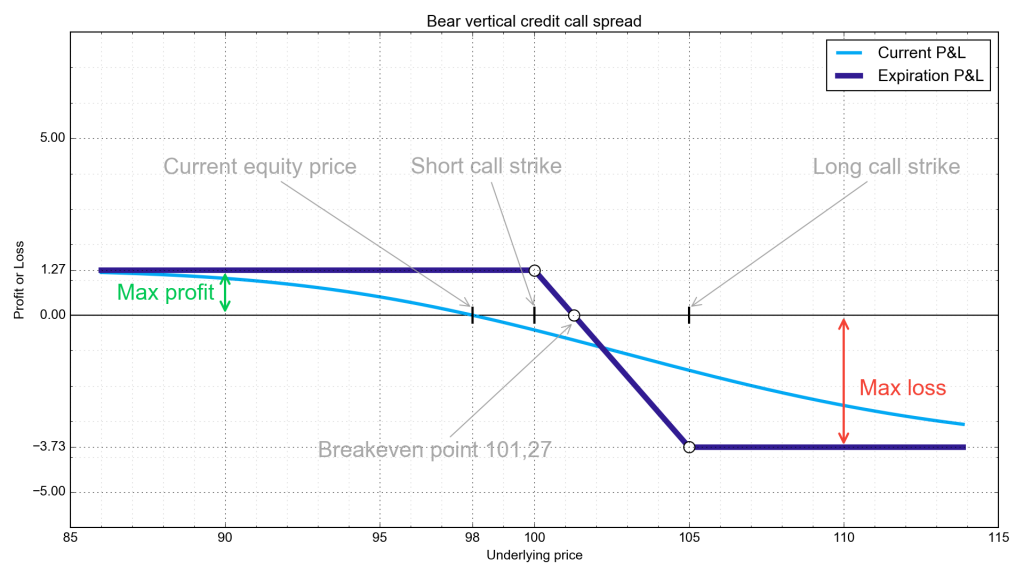

Bear Call Spread. An alternative name is Credit Call Spread. Bearish position. It is a vertical spread involving an equal number of long and short calls on the same underlying asset and with the same expiration date. It is a credit spread, which means you receive money to put on the position. The strategy profits as long as the price of the underlying security remains below the breakeven point.

We prepared a major update for Option Workshop. Many new features have been added to help our users trade efficiently. In the new version, you can change the position’s opening price, set the commission for the exchange/underlying assets/option series/futures, display the IV curves for several pricing models simultaneously, etc.

Looking for protection against inflation or recession while getting paid to wait? Here are a few options to seriously consider. The case for buying precious-metals and miners was recently made here, and now it is time to share our favorite trades. Gold has been like a kite caught in an unrelenting storm for the past ...

In a previous post, I wrote briefly about what investors can expect in 2017 as a result of the Trump presidency and suggested some investment ideas. In part 2 below, I’m going to delve into the merits of precious metals for 2017.

Options trading can appear intimidating to some traders. To make money, you must understand how option values fluctuate, the risks of option positions and the regulations pertaining to option expiration. You can have option positions that expire after periods ranging from one day to more than a year.

In our new version, we have changed the principle of pricing models setting. Now the model is defined as a pair of a computation model (Black, Black-Scholes or Cox-Ross-Rubinstein) and volatility model. You can create multiple models for each series of options and customize them in different ways.

The term “day trading” assumes that a trader opens and closes positions within a single trading session and doesn’t take positions overnight. Also, when talking about day trading, people generally think of instruments such as – equities, ETFs and futures. Not options.

After the release we have received some good suggestions for program improvement. Thank you for your response. Thus, the development plan of Option Workshop in October/November: Show the open interest volume in the Option Desk. Display the theoretical price in the Order book. Add the ability to change the option type of the modeled position.

Today we’re going to talk about how we calculate volatility in Option Workshop, and what our plans are to improve this part of the functionality. Option Workshop is integrated with several data sources, which provides market data for options and their underlyings.