Option Workshop, version 17.3.1431

We prepared a major update for Option Workshop. Many new features have been added to help our users trade efficiently.

There are two new tabs in the Positions manager:

- Orders – contains orders that are linked to selected strategy. On this form, you can place or cancel orders, and shift orders one step up or down from the midmarket price.

- Notes – contains text comments about the selected strategy. You can write comments on any strategy. Notes are displayed when you hover the cursor over the strategy name.

In the new version, you can change the position’s opening price, set the commission for the exchange/underlying assets/option series/futures, display the IV curves for several pricing models simultaneously, etc. We will discuss these and other features in this article.

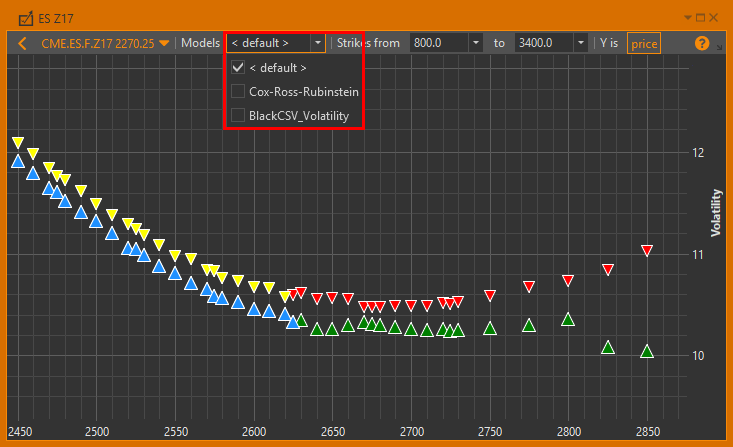

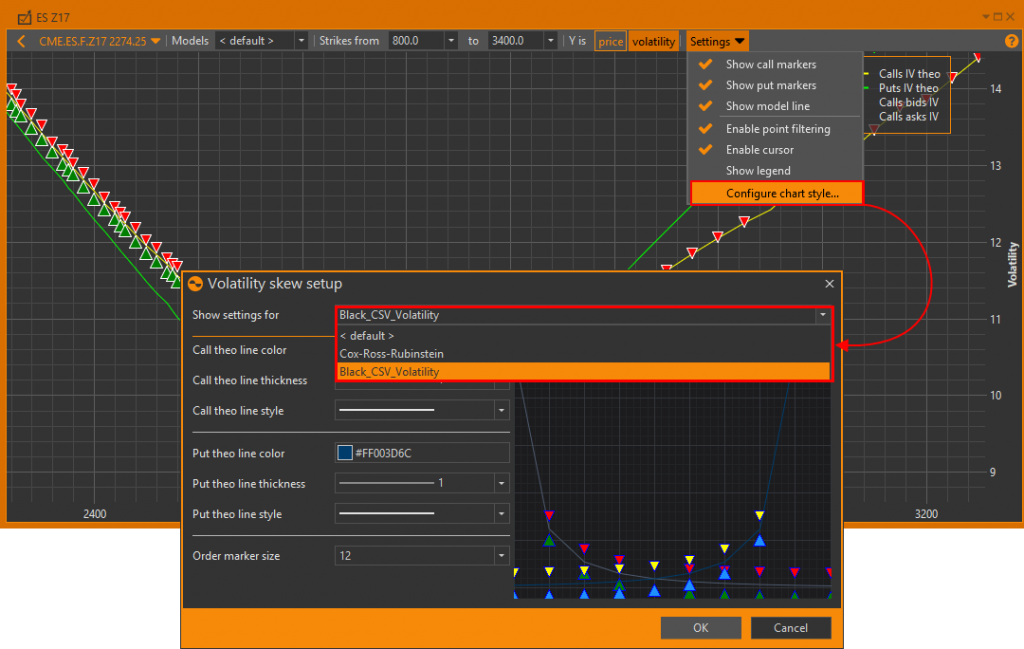

Volatility skew

Now you can simultaneously display IV curves for all pricing models created for this option series. In the Models list, check the checkbox in front of the interest model.

Markers are displayed only for the default model. The default model consists of two parts – a computation model (Black-Scholes or Black) and a volatility model. In Optin workshop the volatility values are calculated automatically. If you’re working with several charts simultaneously, you may set different line style for each of them.

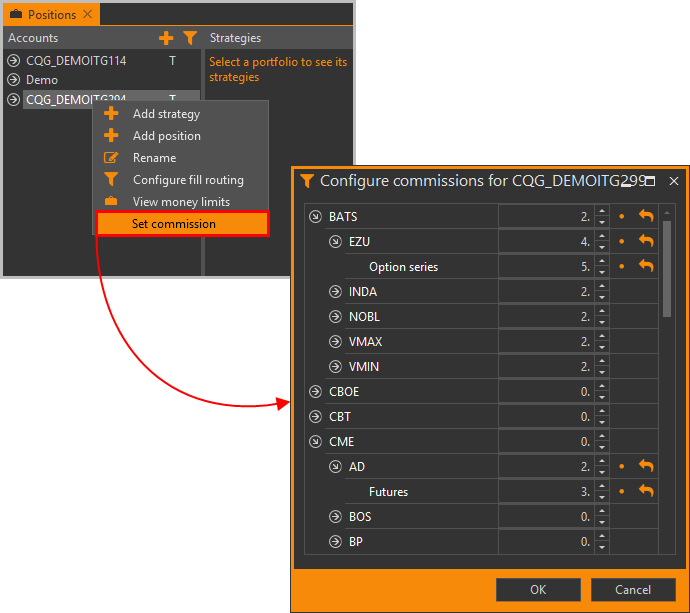

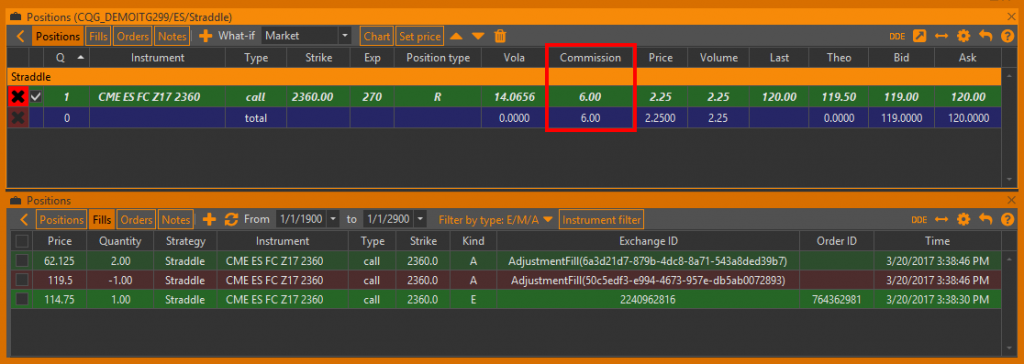

Commission

In Option Workshop, we have added an ability to calculate the fill’s commission. The commission is configured separately for each account. To do this:

- right-click on the account;

- select the Set commission command in the context menu;

- specify the commission size for the exchange/underlying asset/futures/option series.

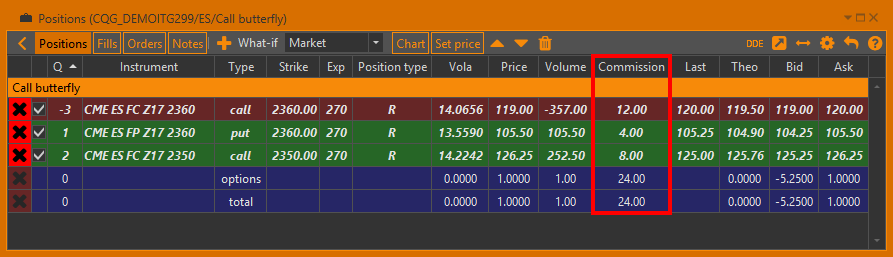

The total сommission for the contracts is displayed in the Commission column in the Positions table.

The commission for the fill is calculated by this formula: the number of contracts in the fill multiplied by the commission size for the contract.

The commission for the position is a total commission of all fills in the position.

The total row shows the total commission for all positions.

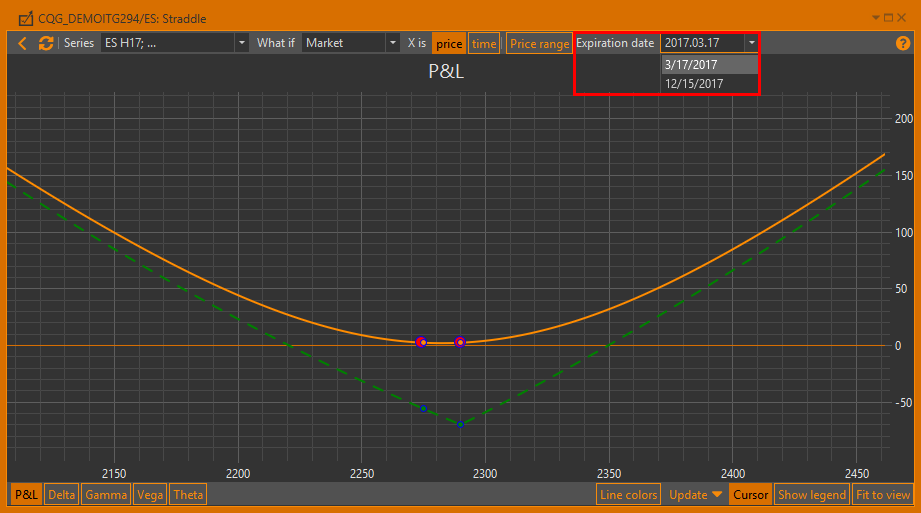

Strategy charts

In previous versions of Option Workshop, if a strategy contains options on different expiration dates, the P&L chart is build on the expiration date of the nearest option.

Now you can select on which date to build the chart.

The drop-down list (Expiration date) with expiration dates of options is available if there are options from the different series. The selected date will be used to build the chart.

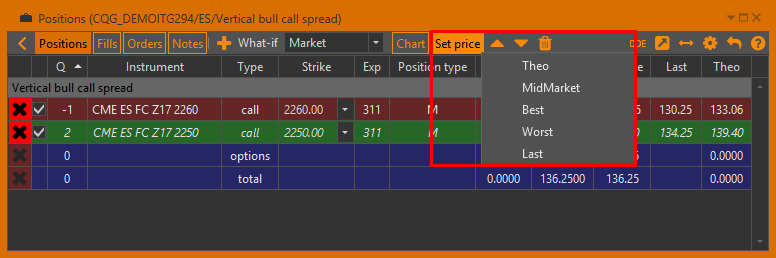

Position opening price

In the new version, you can change the positions’ opening price. Click the Set price button, and a list with following prices will open:

- Theo – theoretical price;

- Midmarket – midmarket price, which is composed of the average of the bid/ask;

- Best – the price of the best codirectional order. In this case, the best bid price will be set for a long position, and best ask price for a short position;

- Worst – the price of counter orders. In this case, the best ask price will be set for a long position, and best bid price for a short position;

- Last price – the last traded price.

When you select any of the items, the appropriate instrument parameter will be taken, and the position price will be corrected. Two adjustment fills will be created. But the position size will not be changed.

Option desk and Spread desk

When you hover the cursor over the tab name (Option desk or Spread desk), a tooltip with the expiration date of the options series will be shown.

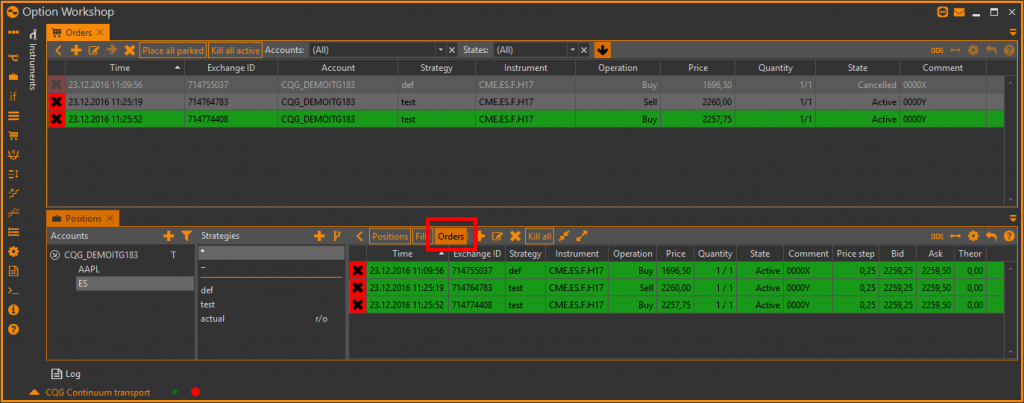

Orders

In the Positions manager, we’ve added an Orders tab. This tab contains orders that are linked to selected strategies. The set of features will be similar to the Orders manager form, plus a few useful tools:

- Two buttons to shift orders: one (

) to increase and decrease the bid and offer prices;

another (

) to increase and decrease the bid and offer prices;

another ( ) to decrease and increase the bid and offer prices.

Prices are updated in one minimum price step.

) to decrease and increase the bid and offer prices.

Prices are updated in one minimum price step. - Additional columns: bid and offer for the instrument, strike, instrument type, price step and theoretical price.

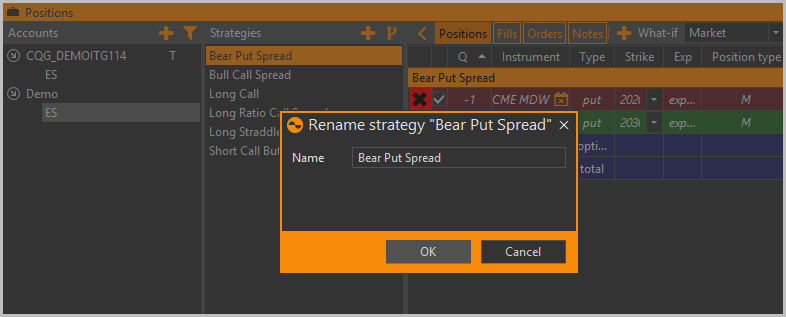

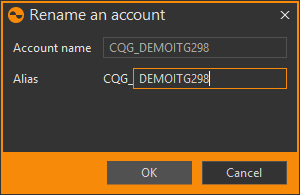

Accounts and strategies renaming

Now you can rename accounts and strategies by double-clicking the name of the account/strategy. The Rename command is also available in a context menu.

Adding comments to the strategy

In the new version, you can add notes/comments to the strategies. We have added a Notes tab in the Positions manager. Simply enter your text and click the Save button.

The note text is displayed when you hover the cursor over a strategy name in the Strategies list.

New column in Option desk

In the Option desk, we’ve added a new column for the call and put options: Open interest. It’s not yet available for all data sources, but will be developed in updates soon.

Interface

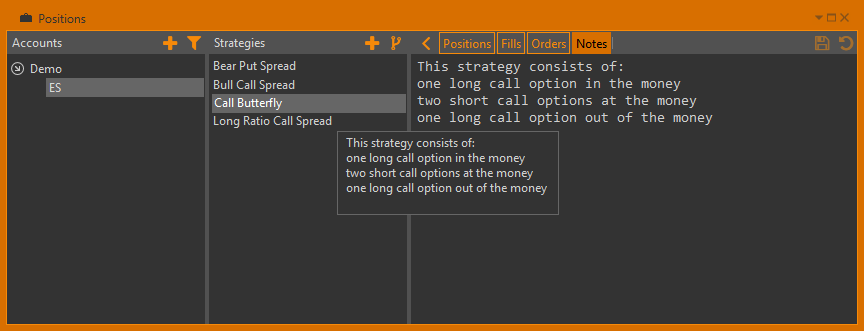

For easy navigation in the Active windows selection window (opened by pressing Ctrl+Tab), forms are now grouped by type:

- Strategy charts;

- Option desks;

- Spread desks;

- Other windows.

To switch between windows, use the arrows on your keyboard.

What we have fixed

- An error when stopping the Delta hedger on a schedule.

- Incorrect calculation of P&L (Money) on expired instruments.

- Zero volatility in Option desk at normal prices.

- An error while creating virtual expired stock options.

- The absence of price rounding when placing orders.

- Incorrect calculation of prices in the Total row in the Positions table.

- Creating the adjustment fills when moving positions to another strategy.

- Incorrect format of order prices in the Option desk.

- Incorrect formation of the volatility skew.

- Incorrect time of the fills received from Interactive Brokers.

Permalink