Option Workshop, version 18.6.1727

Subscription rotation

The main feature we've added in this version is an ability to "rotate" market data subscriptions. The problem which we were trying to solve is the limitation on a number of instruments, for which market data you can subscribe simultaneously. In Interactive Brokers TWS this limit is very low, only 100 instruments. CQG limit is about 400, IQ Feed - 500. You buy an extension for this limits, but it is not cheap.

We have implemented a logic, which split all the instruments for which you need to receive market data (for example, you've opened ten option desks) into groups and then subscribe/unsubscribe for these groups sequentially. This approach allows us to have quasi-realtime market data, which is enough if we are trading manually.

We rotate only options, subscriptions for underlying instruments are always made once and until instrument becomes unused.

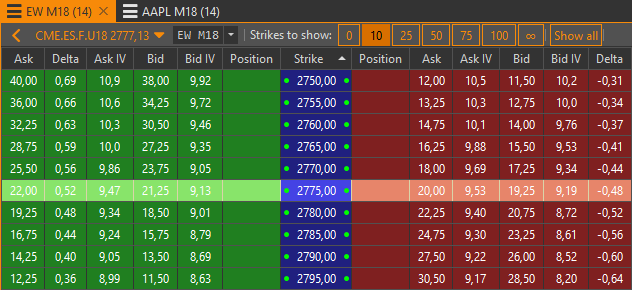

In this context, we've also added a market data "freshness" indicator on to option desk feature. Take a look at the image below.

This indicator is two small dots in cells of the Strike column, right for puts, left for calls. Dot changes it's color from green to red, depending on how fresh a quote is.

Delta-hedger discrete mode

Our super cool feature - delta-hedger has several regimes of work. One of them is "discrete by base asset price." Our users reported several cases when the delta-hedger was trying to hedge while underlying instrument price was in between two reference points. We've fixed this issue.

Permalink