March OptionWorkshop updates v21.3.2294 🌱

Performance optimization, strategy charts improvements, and a lot of behind-the-scenes improvements.

Performance optimization, strategy charts improvements, and a lot of behind-the-scenes improvements.

Charm and Vanna charts, what-if scenarios cloning, caching market data to database, simplifying the program settings at the first launch after installation.

Lots of improvements last month! We optimized charts, updated the connectors’ status bar, fixed user bugs, and much more.

Merry Christmas and Happy New Year :)

We continue to stabilize existing functionality and meticulously, step by step, implement new, useful features with a single aim: to ease the life of options traders. Take a look at what we accomplished in November.

Introducing our new online application Online OptionWorkshop. Please give it a try! What’s the big idea behind the app? To move into online application all functionality unrelated to real-time market data, actual positions, order execution. It includes, but isn’t limited to options positions modeling, historical data analysis, history of IV curves, ATM IV, spreads IVs, and various scanners.

Revamped the OptionWorkshop licensing system. Now the license is linked to authorization by login and password. Users will be able to work under the same license on multiple computers without having to request a second license from support.

We have released a new version of the Option Workshop. Main changes are around the FOS (Futures Orders Stairs) feature. We've rewritten it from scratch. Documentation is not updated yet, thus, a brief description of what has changed below.

User parameters of volatility scew lines now can be marked as default to be used for all new charts. In the instrument tree it 's now possible to see instruments, which does not have options. Vertical line showing current price of an underlying asset added to the volatility scew chart.

Main feature in this version is an ability to rotate market data subscriptions, so we can have a quasi-realtime quotes for as much instruments as we want. We also improved stability of the delta-hedger in "discrete by base asset price" regime.

Polynomial volatility model, notifications through Telegram and Market-maker ergonomic improvements

In this update, we’ve added several improvements: copying a strategy with all fills, a new Mnns (moneyness) column that shows the option status, the ability to bind the Charts form with the active (selected) strategy in the Positions manager, the ability to display the P&L chart taking the commission for the fills into account, etc.

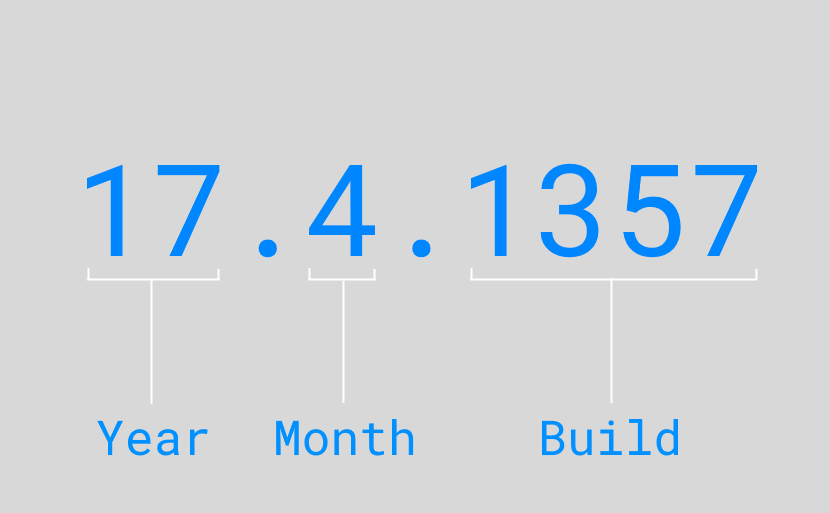

The Option Workshop’s version number consists of three parts: the release year, the release month, the build number – the serial number of the program version. Thus, version 17.3.1431 means that the update was released in March 2017, and the build number is 1431. In social networks, we publish short posts about features that will appear in the upcoming updates.

We've released a small update, which includes only two bug-fixes: The program sometimes hangs when user try to change position price through the Set price button; The program ignores the first line of a CSV file with volatility curve.

We prepared a major update for Option Workshop. Many new features have been added to help our users trade efficiently. In the new version, you can change the position’s opening price, set the commission for the exchange/underlying assets/option series/futures, display the IV curves for several pricing models simultaneously, etc.

In the new version we have unified the format of the options series codes. Now, the codes are displayed in a unified format for all elements in the interface. Also we have made minor changes in the what-if scenarios functionality, exchange visibility configuration window and accounts visibility configuration window.

In our new version, we have changed the principle of pricing models setting. Now the model is defined as a pair of a computation model (Black, Black-Scholes or Cox-Ross-Rubinstein) and volatility model. You can create multiple models for each series of options and customize them in different ways.

Some users might encounter the following issues after installing Option Workshop update 16.11.1268: incorrect notification display: the expiration of the license or a notification about available updates; incorrect price range calculation for the Strategy charts; an error with incorrect position type when moving positions. We apologize for the inconvenience and have fixed these issues.

Release 16.11.1268 entirely devoted to fixing errors and improving the functionality of the program. We have corrected more than 30 issues: interface customization, the functionality of the Positions and Fills table, formatting of the data exported or copied from Option desk, etc. We thank you for your valuable feedback!

The main change of the new version is an ability to customize the line styles for the volatility skew: model lines and markers. Also we continue to improve the functionality of Option Workshop and fix some bugs.