Option Workshop, версия 18.2.1657

Долгожданное обновление Option Workshop. Аппроксимация кривой волатильности по рыночным котировкам, уведомления в Telegram и эргономика маркет-мэйкера.

Долгожданное обновление Option Workshop. Аппроксимация кривой волатильности по рыночным котировкам, уведомления в Telegram и эргономика маркет-мэйкера.

Что нового в Option Workshop версии 17.6.1515: копирование стратегии со всеми сделками, новая колонка Mnns (Moneyness), которая показывает состояние опциона, отображение графика прибыль/убыток с учетом комиссии по сделкам и многое другое.

Видео о том, как подключить Option Workshop к нескольким терминалам QUIK.

Вебинар"«Option Workshop: обновления и доработки" – краткий обзор функций, которые появятся в ближайшем обновлении

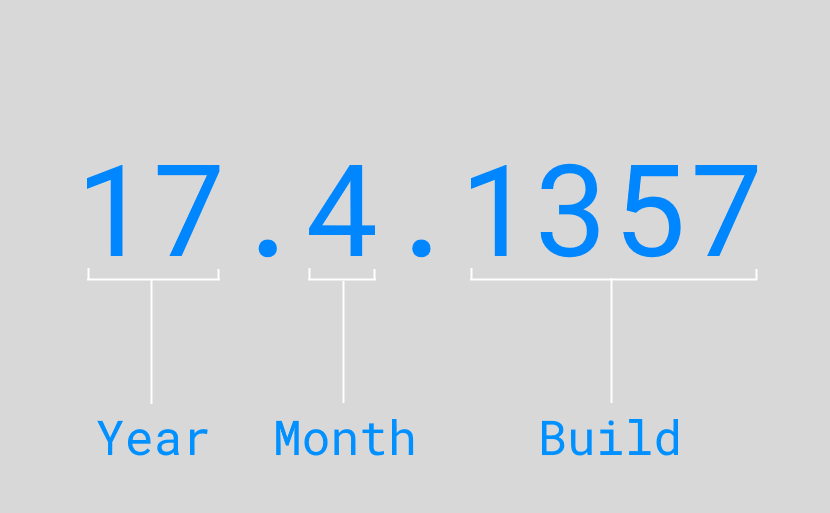

Номер релизной версии Option Workshop состоит из трех чисел: год релиза, месяц релиза и номер сборки.

12 апреля мы провели вебинар "Option Workshop в связке с терминалом Interactive Brokers" совместно со Школой Московской биржи. Рассказали об особенностях интеграции с терминалом, о доступных инструментах и возможностях торговли опционами на западных рынках.

Выпустили небольшое обновление, закрывающее две ошибки: Зависание программы при использовании кнопки Set price и некоторых действиях по переносу сделок между позициями; Не считывание первой строки csv файла при импорте кривой волатильности. Обновиться можно автоматически либо скачать и запустить новый инсталлятор.

Вебинар по Option Workshop – основные принципы работы программы и обзор мартовского обновления

Большое обновление Option Workshop. В версии 17.3.1431 много нового. Закладки с заявками и текстовыми заметками в менеджере позиций, учёт комиссий, множественные графики кривых волатильности, замена цен открытия и много улучшений помельче.

Мы не раз получали вопросы от пользователей о том, как настроить работу Option Workshop, если программы установлены на разных компьютерах. Главная задача, которую нужно решить в данном случае – это корректно синхронизировать настройки и обработать данные двух программ....

Чтоб отключить отладочный режим логирования в Option Workshop, выполните следующие действия: Перейдите в настройки программы. Перейдите на закладку Support. Нажмите кнопку Configure logging. В открывшемся диалоге в выпадающем списке выберите Log only important events. Закройте все диалоги кнопками Ok.

В ноябре 2015 года вышла полностью обновленная версия Option Workshop. В течение года мы активно дорабатывали продукт: исправляли ошибки, улучшали работу текущих функций и добавляли новые (историю изменений можно найти в нашем блоге по тегу «обновление»). Спасибо за ваши отзывы и предложения.

В одной из ближайших версий появится новая закладка, в которую будут отфильтровываться заявки, связанные с выбранной стратегией. Заявки можно будет одним кликом снять, подвинуть на шаг цены к рынку или от рынка.

В новой версии мы привели к единому формату коды серий опционов. Теперь во всех элементах интерфейса код серии отображается одинаково. Также для удобства работы мы внесли небольшие изменения в what-if сценарии, в форму фильтрации бирж и счетов. Об этих и других изменениях можно прочитать далее в этой статье.

В новой версии изменён принцип настройки моделей ценообразования (Pricing models). Теперь модель задается как пара из базовой модели (Black, Black-Scholes, Cox-Ross-Rubinstein) и модели волатильности. Для каждой серии опционов можно создать несколько моделей и параметризовать их различным образом. Так как в настройках модели можно указывать кастомные значения волатильности, мы добавили на графики волатильности (Volatility skew) еще...

В этом видео, на примере стандартной стратегии Call butterfly (бабочки из опционов call), мы показываем, как создавать и применять шаблоны опционных комбинаций.

10 декабря в 11:00 (регистрация с 10:15) ждем вас в Синем зале Геологического музея им.Вернадского по адресу ул. Моховая, 11 стр. 11. Метро Охотный ряд или Библиотека им. Ленина.

После установки Option Workshop 16.11.1268 некоторые пользователи могли столкнуться с: проблемой отображения уведомлений о сроке истечения лицензии, о наличии обновлений; потерей типа позиции при переносе позиции; ошибкой при расчете диапазона цен для графиков стратегий (Strategy charts). Проблемы исправлены. Рекомендуем скачать и установить обновление. Версия 16.11.1273 уже доступна на нашем сайте. Приносим свои извинения за неудобства.

Релиз 16.11.1268 полностью посвящен исправлению ошибок и стабилизации работы программы. Мы закрыли более 30 ошибок: настройка интерфейса, работа Менеджера сделок и позиций, форматирование экспортируемых данных и т.д. Спасибо всем за отклик. Новая версия уже доступна на нашем сайте.

Основным изменением новой версии стала возможность настраивать вид графиков волатильности (Volatility skew): модельные линии и маркеры. Также исправляем ошибки, работаем над производительностью. Графики волатильности (Volatility skew) В новой версии можно настраивать вид графиков волатильности (Volatility skew): выбирать цвет, толщину, стиль линий (сплошная, штриховая, пунктирная и др.) и размер маркеров цен заявок. Для новых графиков применяются...